Share This Post

Contrary to popular belief, climate change is no longer a distant threat; it’s a pressing reality we face today. The escalating costs of natural disasters and their disproportionate impact on vulnerable communities underscore the urgency of adapting to a changing climate and the need to be resilient.

This critical issue took center stage at a recent market series event in Washington, DC, hosted by the Montgomery County Green Bank and M&T Bank. The event “Climate Resilience and Equitable Infrastructure” highlighted the significance of climate resilience in today’s world, with a particular focus on equity.

What is Climate Resilience?

First things first, how do we define climate resilience?

According to The Center for Climate and Energy Solutions (C2ES), climate resilience is the ability to anticipate, prepare for, and respond to extreme climate events, trends, or disasters. This includes both the ability to withstand and recover from extreme weather events and the capacity to adjust to long-term shifts in climate patterns. For instance, here in Montgomery County, climate resilience projects include initiatives like the Tree Montgomery Program to increase the urban tree canopy, and stormwater management upgrades such as rain gardens and permeable pavements to prevent flooding. Additionally, efforts like installing cool roofs to reduce the heat island effect and establishing community resilience hubs provide resources and support during extreme weather events.

In a nutshell, climate resilience is the ability to bounce back and for Montgomery County, resilience becomes a must due to the increasing frequency and intensity of extreme weather events, such as flooding, heat waves, and severe storms.

The Need for Adaptation

Monika Serrano, a mechanical engineer and leader of the Resilience Program at Turner Construction, reminded us that the time to embrace change and adapt is now.

Leading construction companies are taking action in building resilient infrastructure, explained Serrano. They are implementing resilient building practices such as storm protection and floodproofing and investing in studies on heat-resistant measures to combat increasing temperatures.

Water intrusion is one of the biggest threats to indoor spaces. Flooding mitigation measures include raising critical equipment to higher floors and wet-proofing lower floors.

However, Serrano pointed out that only 9% of climate investment is dedicated to adaptation. “Adaptation is happening, but not fast enough, not far-reaching enough.”

Challenges and Biases

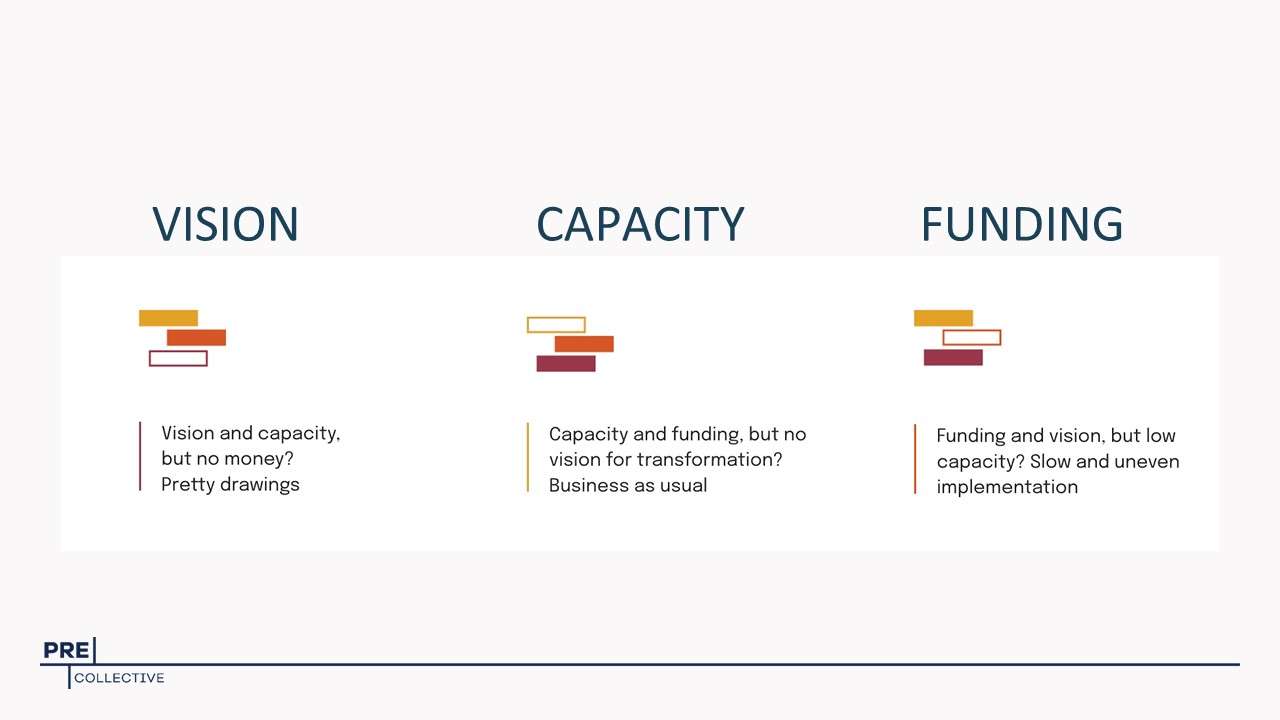

Climate adaptation efforts often face significant challenges despite the clear need for action. These challenges can include a lack of vision or understanding of the long-term implications of climate change, a lack of capacity or resources to implement adaptation measures, and a lack of funding or financial support for resilience projects.

Dr. Shalini Vajjhala, Executive Director of PRE Collective, highlighted the absence of these essential building blocks for resilience projects, pointing out that often, even projects with a clear vision and capacity stall due to a lack of funding.

According to Vajjhala, vision, capacity, and funding are the three building blocks. “Everybody cares the most about funding,” pointed out Vajjhala, but all the building blocks are equally important and connected. “Imagine, you got capacity and funding but no vision for transformation,” she asked the audience.

Meanwhile, Serrano elaborated on the psychological biases that hinder disaster preparedness. “We’re not wired to think of the long term, to remember what went wrong, to do things differently, or to focus on complexity,” she explained. “These biases … make it challenging to prioritize adaptation measures.”

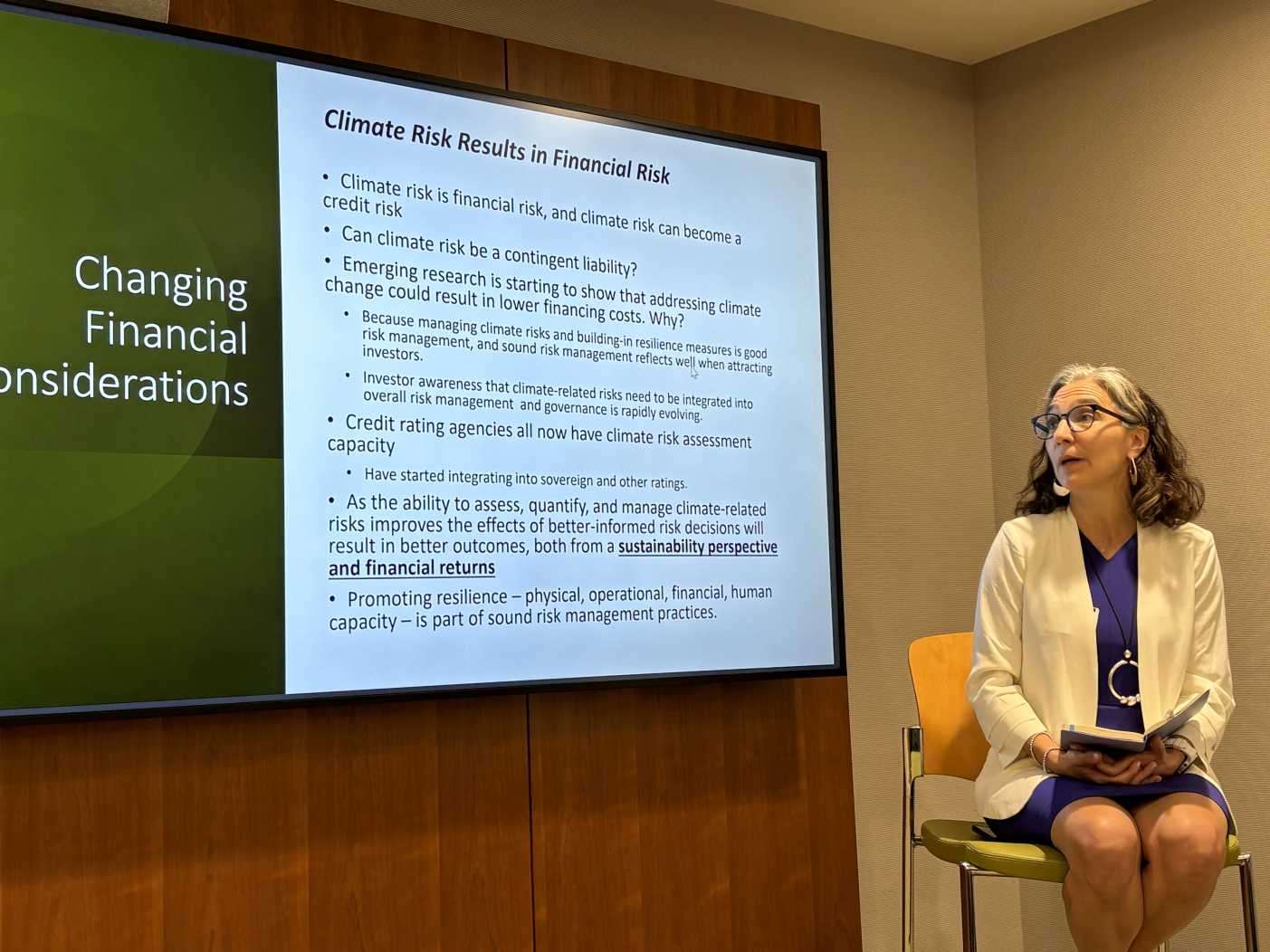

The Role of Investors

Stacy Swann, founder of Resilient Earth Capital and a Green Bank board member, discussed the growing awareness among investors about the financial risks posed by climate change. “The physical impacts from climate change are no longer tail risks,” Swann asserted. Extreme weather events, once considered rare occurrences, are now common.

The financial toll of climate-related disasters is staggering. According to data from the National Oceanic and Atmospheric Administration (NOAA), the US has sustained 376 separate weather and climate disaster events since 1980. The cumulative cost for these 376 events exceeds $2.660 trillion. These events disproportionately affect vulnerable populations, worsening existing inequalities.

Investors are recognizing that climate change can lead to reduced revenues, business interruption, and increased insurance and input costs. The Task Force on Climate-Related Financial Disclosures (TCFD) framework, a global initiative that encourages companies to disclose their climate-related financial risks, is gaining momentum. This framework prompts companies and organizations to assess and disclose their climate-related financial risks, thereby increasing transparency and enabling better risk management.

Gabriela Kluzinski, Investment Manager at DC Green Bank, shared insights into the bank’s role in financing stormwater retention projects. The bank provides capital for projects that reduce stormwater runoff and supports the development of a resilient stormwater management market.

The Washington DC Department of Energy and the Environment (DOEE) has introduced the Stormwater Retention Credit (SRC) Program to attract private capital by leveraging public funds for stormwater management. Key elements, such as the Price Lock Program and Aggregator Startup Grants, launched in late 2017, aim to boost investor confidence and interest. The program incentivizes green infrastructure by allowing developers to finance offsite projects through stormwater credits, thus maximizing environmental benefits across the district. The SRC program receives substantial support from the DC Green Bank, which provides the necessary financing to scale these projects and attract private investment, ensuring the program’s success and sustainability.

Kluzinski also emphasized the need to work with partners: “We’re working with other partners, including PRE Collective, to figure out and fine tune exactly where we want to have and provide our financial products in the future and to continue growing and supporting the market that’s here in the district.”

This collaborative approach is essential for ensuring that climate resilience investments are targeted and effective in addressing the needs of vulnerable communities.

The Importance of Equity in Climate Resilience

True resilience cannot be achieved without addressing the deeply rooted inequities that make marginalized populations more vulnerable. In the context of climate resilience, equity means ensuring that the benefits and burdens of climate resilience efforts are distributed fairly, taking into account the different needs and capacities of various communities.

The link between economic mobility and climate resilience is undeniable. Economic mobility refers to the ability of individuals or households to improve their financial status over time. This underscores the need for a holistic approach that tackles socioeconomic disparities and climate vulnerabilities in tandem.

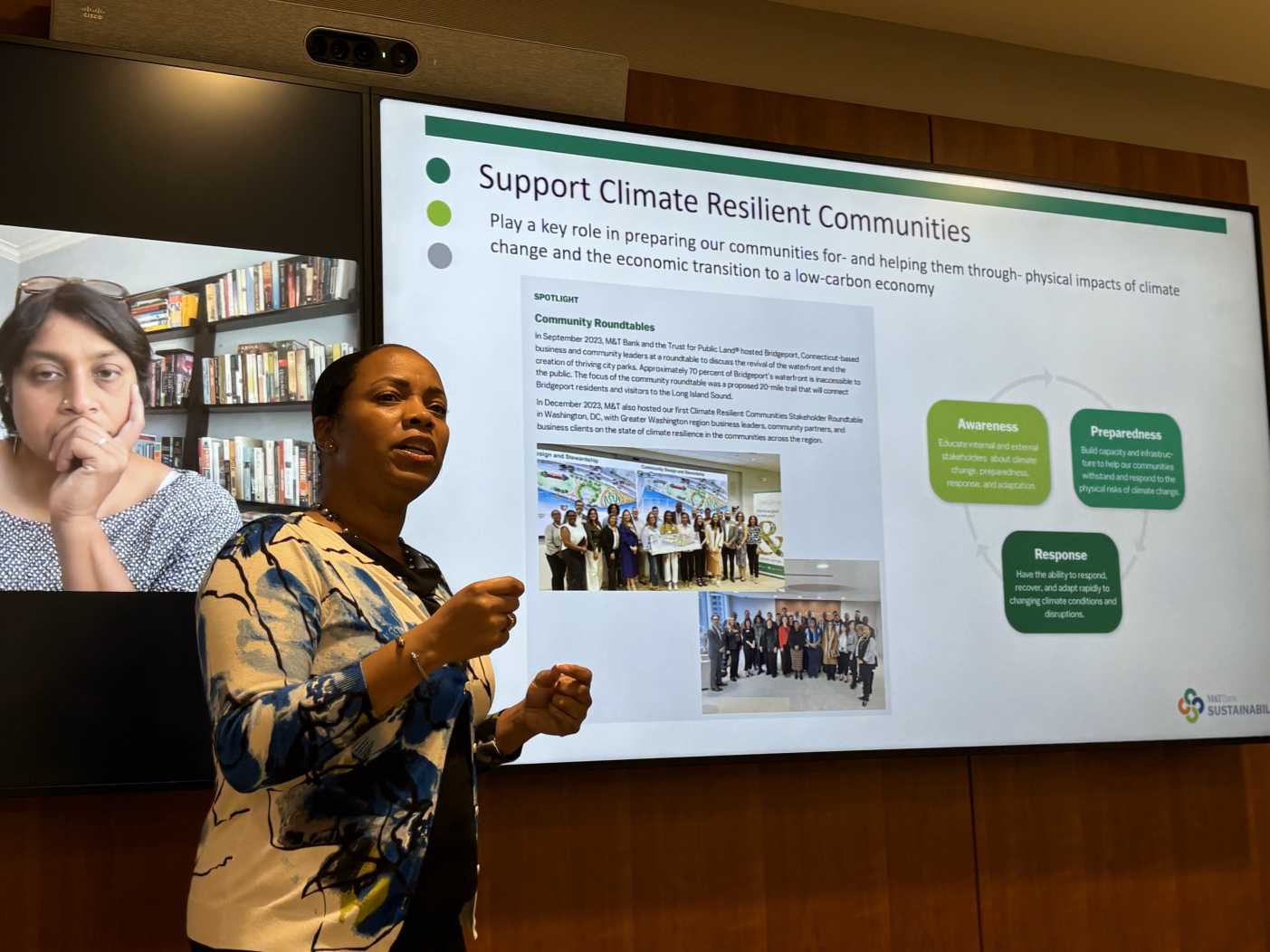

LaKendra McNair, Head of Climate Resilient Communities at M&T Bank, stated: “We should look at economic mobility and climate resilience as co-dependent attributes in empowering equitable sustainable communities.”

Central to this approach is centering community voices and experiences in resilience planning. This means involving community members in decision-making processes, understanding their needs and concerns, and incorporating their perspectives into resilience strategies and execution.

Dr. Shalini Vajjhala highlighted the importance of asking the two very different questions, “Who loses money if we don’t get this right?” and “Who suffers if we don’t get this right?” She added that equity really comes in at the very first moment you start thinking about climate resilience.

By recognizing that financial losses are not the sole indicator of climate impact, we can ensure that resilience efforts prioritize the needs of those most at risk.

Building Trust: Community-Centered Approaches

McNair also underscored the importance of community engagement in building resilience. “Considering the capacity to sustain the community benefit of this work is essential; while considering if community-centric public private partnerships can support this work.”

Building trust with communities is paramount for effective resilience initiatives. McNair emphasized the need for proactive engagement, stating, “Community resilience is cycle work. Building trust in the community starts with playing a role in community resilience awareness, preparedness, and response.” By building relationships and understanding community needs before disaster strikes, we can co-create truly equitable and sustainable solutions.

Looking Ahead

The event concluded with a discussion on the need for a shift in mindset from retroactive ESG reporting to proactive climate investing. Panelists emphasized the importance of asking the right questions, understanding community needs, making communities part of the solution, and building trust through action.

The Montgomery County Green Bank is focused on connecting funds to projects for a greener, more resilient Montgomery County – including building capacity among local communities in understanding how to manage and mitigate climate risk, improving overall understanding in key players and potential paths to move forward in identifying resilient investments that would end up benefiting the most vulnerable individuals and communities.

As part of MCGB Climate Resilience Strategy, the Green Bank has launched a Climate Resilience Piloting Phase, which is intended to provide a clear understanding of priorities based on current hazards, sensitive groups, and capacity to adapt, as well as pre-existing conditions at a deep granular level. Pilots will enable the Green Bank to identify current and future opportunities that open the door to initiate, advance, or integrate resilience activities. Also, understand information gaps, especially those related to risk and vulnerability, at the local level. For more information on the MCGB Climate Resilient Strategy and pilots, email us at info@mcgreenbank.org.