Share This Post

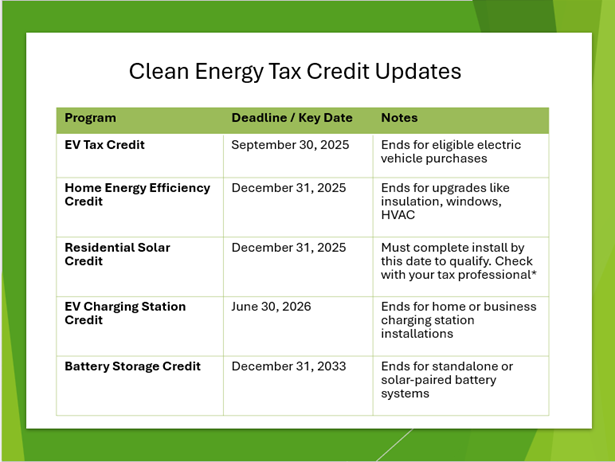

The Inflation Reduction Act originally extended many clean energy tax credits until 2033. However, on July 4, H.R. 1, also known as the O.B.B.B.A, changed many of those dates. Here’s what this means for residents, businesses, and everyone in between: the good news, the challenges, and what to expect moving forward.

For Residents

For residents looking to purchase electric vehicles, the $7,500 tax credit ends on 9/30/2025. Residents looking to take advantage of tax credits for home energy efficiency upgrades have until the end of 2025. Likewise, residents interested in installing solar PV panels have until the end of 2025 to qualify for their tax credit.1

The good news is that post 2025, residents can still take advantage of installing solar PV using a third-party contract called either a Power Purchase Agreement (PPA) or a Lease.

The benefits of a third-party contract are:

- Insurance is included in the cost of the solar PV system.

- Operations and maintenance are included for the length of the contract.

- No loan or upfront payment needed.

The electric vehicle charger tax credit, on the other hand, is available until 6/30/2026.

For Businesses

Businesses that have not already installed solar PV panels can still get the commercial solar tax credit if the installation starts before 7/4/2026 or if the solar PV system is placed in service by 12/31/2027. 2

Starting on 1/1/2026, special rules will pertain to materials and assistance from countries called Foreign Entities of Concern.3 In summary, the best time to install solar is before the end of 2025 if you want to avoid the new FEOC rules. Unsure of how to get started? Let us know by sending an email to cmccabe@mcgreenbank.org.

Good news! – The tax credit for battery storage has not changed and is still available until 2033. If you want to have backup power in case of a storm, this is your time to shine! You can add batteries to an existing solar system, or you can get a solar PV + battery storage system installed and get a tax credit on the batteries.

Montgomery County property owners can qualify for special rates and financing through the Montgomery County Green Bank’s programs.

1 Consult your tax professional for qualifications and how to apply for tax credits

2 IRS Guidance on what constitutes construction commencement expected around August 18, 2026

3 Starting in 2026, no foreign entity of concern can claim the energy tax credits. Additionally, any projects claiming energy tax credits must adhere to strict limits on the materials and components they use that originate from these foreign entities, including ownership, control percentages, and licensing restrictions.