Share This Post

Climate risk has emerged from the fringes to become a critical factor in financial planning. Leading the change are Forbright Bank and Climate First Bank. The latter is a community bank headquartered in Florida, which has established itself as a leader in promoting sustainability through its banking practices.

With the potential economic and environmental upheavals brought on by climate change, understanding and managing these risks has become essential for long-term financial stability and growth. Financial institutions around the world are moving towards a more climate risk management business model and increasingly reevaluating their portfolios to identify those risks and thereafter integrate climate risks into their risk management strategy. Driven by regulatory pressure in other regions of the world, shareholder activism, and growing public concern over environmental sustainability, banks, insurance companies, and investment firms are increasingly scrutinizing their investments in industries and projects considered environmentally harmful or unsustainable.

Portfolio awareness will lead to more green investments. This reevaluation involves divesting from fossil fuels and other high-carbon sectors and entails a strategic pivot towards financing clean energy, energy efficiency and climate resilience projects, and companies that demonstrate strong environmental, social, and governance (ESG) criteria.

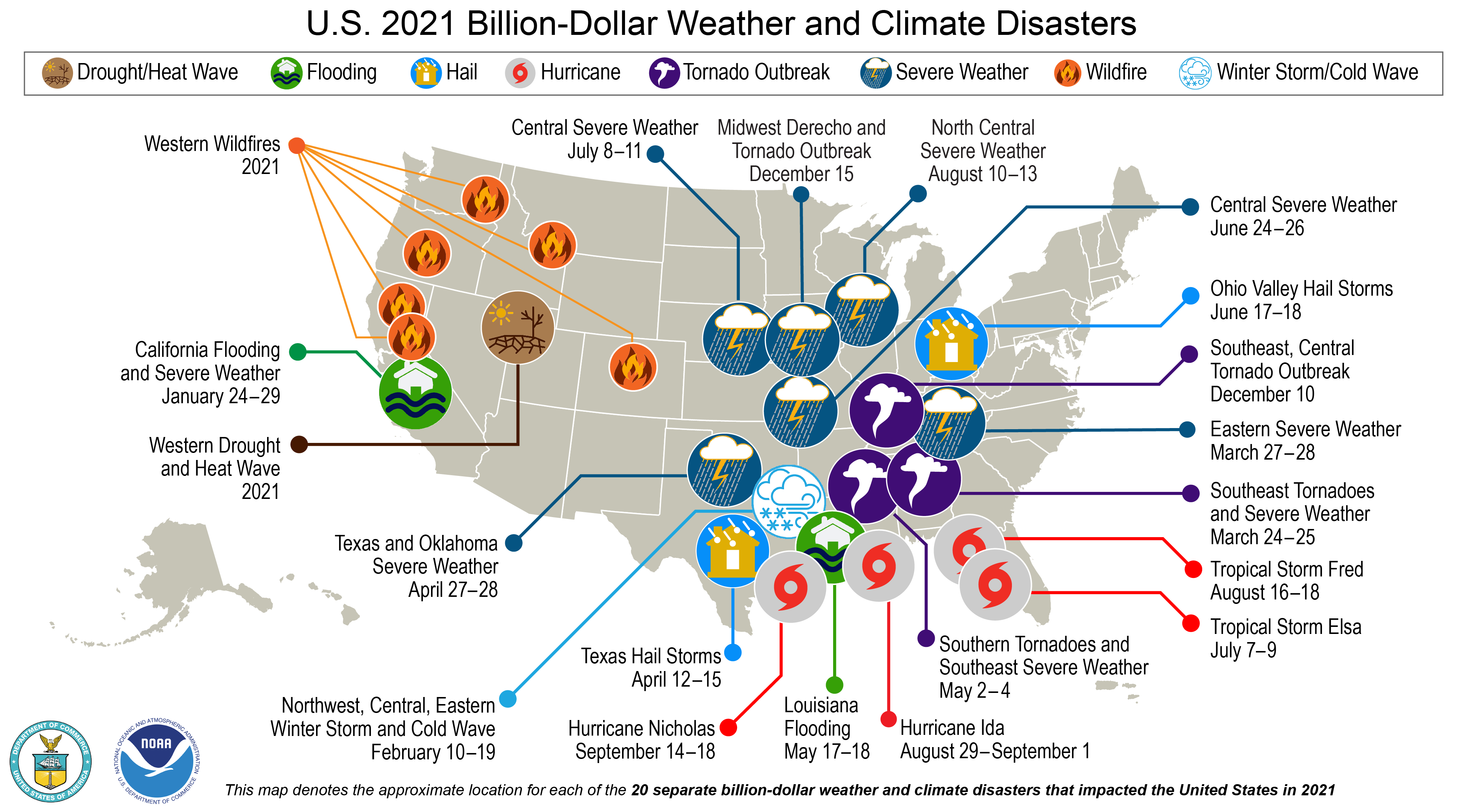

In 2021, the United States experienced record-smashing 20 weather or climate disasters that each resulted in at least $1 billion in damages. NOAA map by NCEI. Credit: Climate.gov media

So What’s Climate Risk Exactly?

Climate risk refers to the potential negative impacts of climate change on economic and financial stability and is a driver across other types of risk, including credit risk. It encompasses both the tangible physical risks, like extreme weather events and gradual climatic shifts, and transition risks, which arise from adapting to a low-carbon economy. The more financial institutions tackle physical risks, the less they have to worry about transition risks.

According to the National Oceanic and Atmospheric Administration (NOAA), in the United States alone, the total cost of weather and climate disasters exceeded $145 billion in 2021. These events cause immediate economic losses and have long-term financial impacts on businesses and communities.

A study by the Network for Greening the Financial System (NGFS) suggested that climate change could reduce global GDP by as much as 25% by the end of the century without adequate mitigation efforts. This reduction in GDP would significantly affect the value of a wide range of assets.

In his 2021 annual letter to CEOs, Larry Fink, CEO of BlackRock, said, “Climate risk is investment risk. Indeed, climate change is almost invariably the top issue that clients around the world raise with BlackRock.”

In the bustling heart of downtown Bethesda in Maryland, a dialogue organized by the Montgomery County Green Bank unfolded among financial experts dedicated to integrating climate risk management in financial institutions. The common consensus among the panelists was that these risks present significant challenges and opportunities for the financial sector, influencing investment decisions, asset values, and long-term strategic planning.

Chris Cucci, Chief of Staff at Florida-based Climate First Bank, said the way they combat the climate crisis is by providing lending solutions, both consumer and commercial lending, that positively impact people and the planet. Climate First has a green-only portfolio which draws like-minded clients to their bank. As Chris explained, “Customers come to us only for our mission, they are not shopping around and the only reason is that they support what we do.”

“This includes everything from renewable energy, EV charging infrastructure, green building retrofit lending, and then also some things on the social impact side that ultimately tie into doing what’s right for people and community,” pointed out Cucci.

Insurance: A Barometer of Climate Risk

The changing insurance landscape, particularly in regions like Florida, clearly shows the growing physical risks associated with climate change. According to a report by Swiss Re, one of the world’s largest reinsurers, the global insurance industry is facing increasing claims due to climate change-related natural disasters. The report indicated that the gap between total economic and insured losses (the protection gap) has been widening. The increase in insurance costs is tangible evidence of how this risk is perceived by insurance companies.

“Insurance costs against certain types of physical hazards will increase as those hazards start to increase, and availability of insurance may decrease. This means costs for insuring assets against climate-related risks are likely to rise. At the same time, it may become harder to even find insurance coverage,” said Stacy Swan, CEO of Resilient Earth Capital.

Meanwhile, Chris Cucci said that in Florida, the insurance cost had increased so much that it is negatively impacting property valuations. “As insurance becomes more expensive, the net income of investment properties decreases, which in turn affects their overall value. This situation is creating a slowdown in property sales, especially along the coastline, highlighting the direct impact of rising insurance costs on the real estate market.”

Economic Opportunities

Financial institutions are increasingly reevaluating their portfolios in response to climate risks.

The industry is shifting towards recognizing both the direct impacts of climate change and the economic implications of transitioning to a sustainable, low-carbon economy. “We’ve gone on this journey at our bank to really… start assessing climate risk in our existing portfolio,” Sonia Khanna, Managing Director of Forbright Bank, explained.

Khanna’s story of Forbright’s transformation from a commercial bank to a sustainability-focused entity highlights this trend. “We were probably $2 billion in assets three years ago, and we’re now just under $7 billion,” she remarked, illustrating the growth potential in aligning with sustainable practices.

The Global Sustainable Investment Alliance reported that global sustainable investment reached $35.3 trillion at the start of 2020, equating to 36% of all professionally managed assets across the regions covered. This reflects a growing recognition among investors of the importance of considering environmental risks in their portfolios.

The Energy Transitions Commission estimates that achieving a zero-carbon economy by mid-century will require investment of around $1–2 trillion per year globally, representing approximately 1–1.5% of global GDP.

This transition, while costly, opens up numerous investment opportunities in renewable energy and energy efficiency solutions that increase climate resilience. Christiana Figueres, former Executive Secretary of the UN Framework Convention on Climate Change, said in a 2020 interview in Forbes: “There is no doubt that the financial sector has begun to see the light, understanding that climate risk is investment risk, but also, more importantly, understanding that climate action is a huge economic opportunity.”

Incentivizing Sustainability: A Strategic Imperative

Financial institutions like Climate First Bank are incentivizing sustainable practices. “We can incentivize through things like higher advance rates… The other thing typically is there are minimum requirements to qualify for a loan,” explained Cucci.

One of the key strategies employed by Climate First Bank is offering favorable loan terms for environmentally friendly projects. For instance, the bank provides lower interest rates and higher loan-to-value ratios for commercial and residential properties that meet specific green building standards, such as LEED certification or energy-efficient designs.

In addition to green building financing, Climate First Bank extends its sustainable incentives to renewable energy projects. The bank offers specialized loans for solar panel installations on homes and businesses, often with more attractive terms than conventional loans. In addition to that, Climate First Bank engages in community outreach and education to promote sustainability.

Evolving and Embracing Change

As the financial sector navigates the complexities of climate risks, it faces a path of continuous evolution and adaptation. The insights shared during the Montgomery County Green Bank event underscore the pressing need for financial institutions to integrate climate risk into their core operations, fostering a more resilient and sustainable financial landscape.

According to Swan, building resilience by focusing on the physical effects we already know we will have to deal with, is a “really good business decision.” Swan’s career trajectory, evolving from Climate Finance Advisor to Resilient Earth Capital, mirrors the industry’s broader realization: climate-related challenges are both threats and harbingers of opportunity.

According to Swan, there is no need to create a massive program, there are small, simple steps that can be taken immediately to start the journey. However, building resilience and integrating climate risk management into financial and business strategies is essential for managing costs in the future.